The Property Tax in Rajasthan

The Property Tax in Rajasthan

States like Rajasthan levy a property tax on their residents. People have to pay a sum of money to the government for staying in a particular house, bungalow, or mansion for years. Let’s read the blog to find out more about the property tax in Rajasthan and the guidelines people follow while paying it.

The property tax in Rajasthan is levied by the municipal corporations and the different committees. These institutions come under the Urban Development Tax Department of Rajasthan and have to comply with the rules stated by the law.

A variety of people pay the property tax for living on the premises of the houses for eons. Also, by paying some portion of their income, they provide the government with the required funds for the betterment of their lives.

What is the purpose of a tax?

The property tax in Rajasthan is levied on the citizens who occupy property in the state.

More importantly, a property tax is the fundamental source of revenue for the government. The municipal corporations levy it to maintain the civic lives of the people and provide them with all the amenities in the world.

For instance, the money collected by the government is used for the maintenance of the streetlights, waste management system, parks, roads, parking areas, and footpaths.

If anyone cannot pay the tax, he/she has to face the issue. Some part of a person’s income is deducted, and they come into the bad books of the government. Such citizens are not considered conscientious by the people of the law. They are considered no less than a liability to the state.

The categories of property tax

While paying property tax in Rajasthan, he/she has to consider the following categories:-

Personal property

This encapsulates movable man-made objects such as cars, buses, scooters, and cranes.

Land

In this scenario, "land" refers to the barren land without any construction done on it. It must not include any improvisations done on the land to improve the quality of the soil or the level of the ground.

Improvements made to the land

These processes encompass the additions made to the land. These could refer to the construction and the building of warehouses.

Intangible property

This means the parts of the property that do not have any physical form. These constitute the copyrights, patents, and royalties.

Exemption on property tax in Rajasthan

While levying the property tax in Rajasthan, there are some dos and don’ts that people adhere to.

Interestingly, the government has imposed an exemption of 50% on the house tax and 100% on the interest. The citizens who haven’t paid their house taxes before 2012 have been exempted from paying the urban development tax on their properties.

Apart from this, if the person possesses innumerable properties, then he/she is liable to pay the property tax for only two houses or properties under his name.

Moreover, if the house is only used for conducting business proceedings and company meetings, then the owner does not have to pay any tax.

Documents required for the property registration process

An individual must possess the following documents for the process of property registration:-

- Aadhaar Card

- Passport-sized photographs of the buyers and sellers

- A verified copy of the original sale deed

- A photocopy of the No-Objection certificate issued under the Land Ceiling Act

- A photocopy of the latest property registry card

- A photocopy of the municipal tax bill

- The document of the power of authority in case the party is representing someone else

- A photocopy of the Power of Attorney if the party is a company

- The receipt of stamp duty payment

- The registration fees

- The photocopy of the agreement between the builder and the buyer

- The completion certificate

- The photocopy of the building approval plan

More importantly, the person must note that the above documents must be valid and should not be expired. Without these documents, the procedure cannot be completed and one might get into a vicious circle.

Also Read - Property Registration Process

How to pay the property tax online

One can follow these steps to pay the property tax online without any hassle.

Step 1 Log in to the property tax registration website. Apply Now

Step 2 Find the link that says "online services" at the bottom of the page.

Step 3 In the property tax section, select the online filing of the property tax returns.

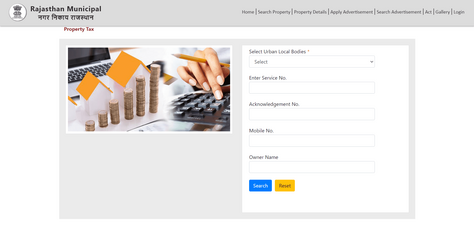

Step 4 Read the terms and conditions carefully and proceed to click on the option that says to click here to file the property tax returns.

Step 5 Fill in the form and enter your property ID, assessment year, revenue survey, and plot number.

Step 6 Keep all your property documents with you.

Step 7 Calculate the property tax online.

Step 8 Print the tax statement.

Step 9 Verify all the details before making the payment.

Step 10 Pay the property tax through your credit cards, debit cards, or net banking.

Step 11 Contact the tax collection teams.

Step 12 Check the property tax receipt.

These online payments have facilitated the property tax returns. In Rajasthan, several online portals have been developed that help people pay their taxes and live a worthwhile life free of debt and fraud.

How to pay the property tax offline

Interestingly, there are a few people who do not comprehend the ABC of online portals. They do not have the know-how to operate these websites and make the payments.

Therefore, these people can make their payments by visiting the office. The staff of the offices can instruct them to go about the process and deposit the fees in a hassle-free manner.

- The property tax can be paid at the different centres in Rajasthan.

- One can look for the specific counters at the property tax offices.

- Carry out any formalities if required.

- Keep the photocopied documents with you in case the employees of the office mightask about them.

After depositing the fees, it is important to collect the property tax receipt.

Summing it up, the process of paying the property tax in Rajasthan is not that intensive. One must possess all the required documents and could deposit the fees through the online or offline methods. One does not have to pay a huge amount of money that would burn a hole in the customer’s pockets.

Conclusion

In the state of Rajasthan, the property tax is collected and maintained by the rural development department under the secretary of rural development. In the city, it is done by Municipal Corporation. Property Tax in Rajasthan - It is levied on all kinds of immovable properties including land, buildings, factories, shop and apartments etc. also includes personal property such as vehicles, gold ornaments etc.

We hope you will learn about the Property Tax in Rajasthan from the information provided in this blog. Propira is a knowledgeable real estate consultant who deals with flats in Alwar, Rajasthan.

If you want to learn more about the Difference Between a Flat and Apartment, then you can get in touch with us by requesting a call back from our team.

Write Comment